How Much Do US Sportsbooks Pay in Tax?

Since 2018, 38 US states have legalized and imposed taxes on sports betting. The year 2018 was the year the Professional and Amateur Sports Protection Act of 1992 (PASPA) was overturned, allowing states to open up to sports betting; if they wish.

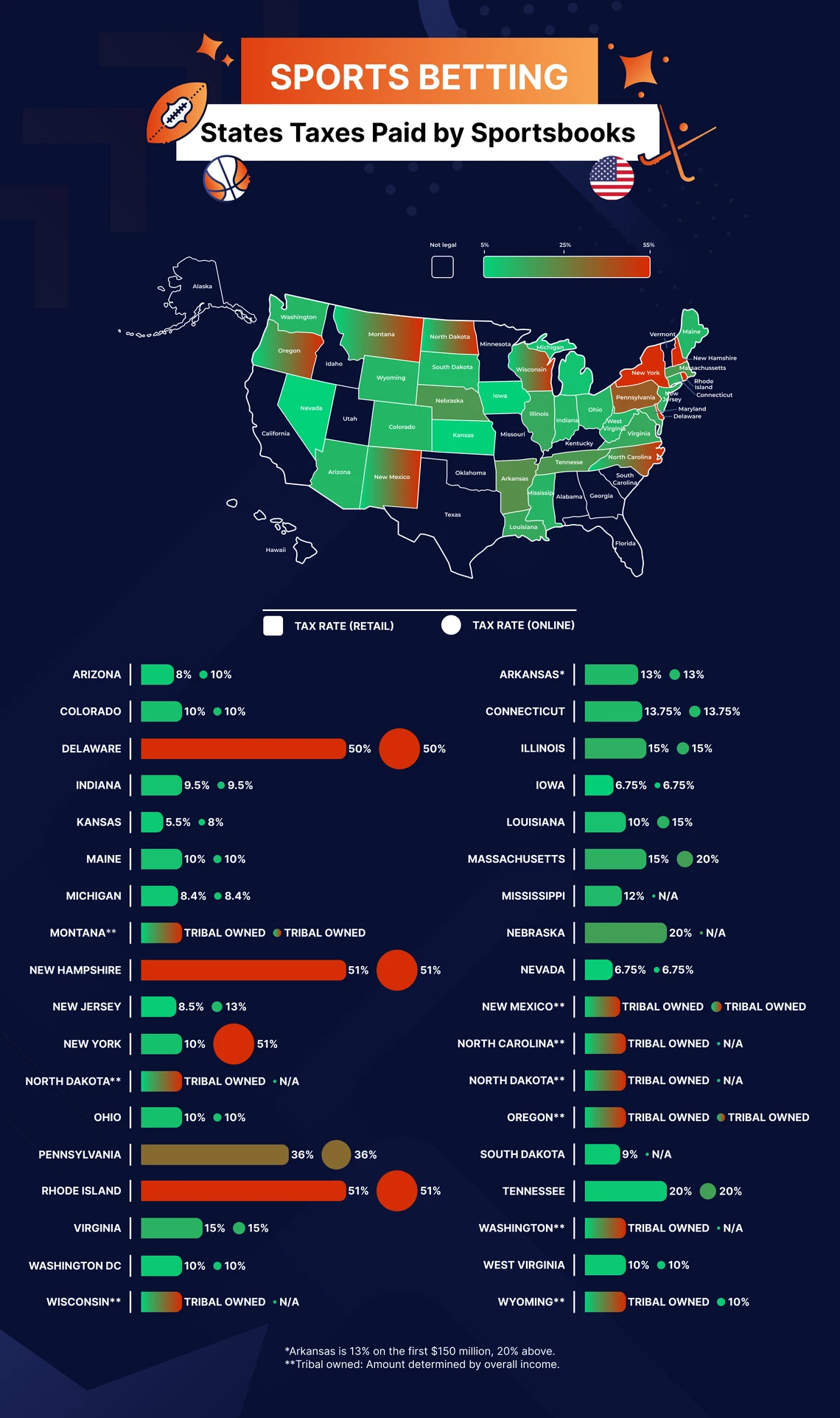

Almost every state has a completely different tax design, when it comes to sports betting, and it can vary from extremely low rates, to over 50% needing to be paid from sportsbooks across the US. Therefore, in this article we delve into the exact tax rates paid by every single state, and compare the differences between revenues and taxes paid; from the lowest tax rate states to the highest tax rate states.

States with the Highest Tax Rates for Sportsbooks

As of 2024, the US has generated $19.61 billion in handle across the months of January and February, and of this $1.92 billion makes up the revenue; and of that $406.6 million is tax that has been paid so far. This means on average, the tax applied to sportsbooks widespread across the US comes in at a rate of circa 21%; but that is far from the reality.

The states with the highest tax rate for sportsbooks are: Delaware, New Hampshire and Rhode Island. Delaware taxes sportsbook operators 50%, both retail and online; while the latter two states tax sportsbooks 51% for both retail and online.

As of January and February 2024, Delaware sportsbooks paid $1.59 million in taxes; for the same period, New Hampshire paid $7.3 million; and Rhode Island paid $4.7 million in taxes.

For clarity, during the same timeframe, Delaware revenued $2.6 million; New Hampshire revenued $16.4 million; and Rhode Island made $9.1 million in revenue.

States with the Lowest Tax Rates for Sportsbooks

Whereas on the flip side, the states taxing sportsbook operators the least stands to be: Kansas, Nevada, and Iowa. Kansas sportsbooks are taxed at a rate of 5.5% in-house and 8% online, meanwhile both Kansas and Nevada tax their sportsbooks 6.75% for both retail and online.

Kansas legalized sports betting in 2022, so they obviously took a leaf out of Nevada’s book, in regards to tax guidance, as Nevada was the first US state to legalize sports betting back in 1949 and was the only state with a legal sportsbook up until the overturning of PASPA in 2018.

As of January and February 2024, Kansas sportsbooks paid $1.7 million in taxes; for the same period, Nevada paid $8.4 million; and Iowa paid $2.4 million in taxes.

Additionally, when it came to revenue, during the above two months, Kansas sportsbooks made $29.3 million; Nevada revenued $123.8 million; and Iowa made $35.7 million in revenue.

Do Tribal Sportsbooks Pay Tax?

For those states not mentioned, that have legalized sports betting but don’t pay a tax, such as: Montana, New Mexico, North Carolina, North Dakota, Oregon, Washington, Wisconsin and Wyoming - these States have tribe-owned sportsbooks, so therefore are not obliged to pay a set tax on their gambling revenue to the State. This is because Native American tribes and their wholly owned tribal corporations are not subject to federal income taxes on their earnings.

Are Promotions Accounted for within the Tax?

You may have noticed some wild sports betting welcome offers, such as 'play with $5 get $200 back in bonus bets' for example; this is because promotions and free bets are sometimes not accounted for within the tax. To figure out how much tax needs to be paid, sportsbooks report their gross gaming revenue (GGR), which is how much has been wagered, minus how much money has been paid out to the winners; divided by the tax rate.

Promotional bets can take up a vast majority of handle and revenue, however, a lot of states don’t permit sportsbooks to exclude promotions from their GGR, causing them to be taxed on revenue that never actually existed. Additionally, you are unable to capture the real revenue of the sportsbook and state due to this.

It could be argued that incentivizing gambling with promotional offers and free bets can carry negative externalities, so lawmakers justify the tax design - to include promotions - as they can, in the long-term, somewhat pay back society through this.

However, by taxing the GGR and including promotional offers, a situation is created whereby the tax rates can make it potentially impossible to run a business, especially with offers.

To say the least - states looking to legalize and tax sports betting, in the coming years, should take note of the experience in the states that went before them!

Author

Content Writer