No Deposit Bonus

Enjoy 88 Free Spins upon registration, no deposit needed!

Welcome Bonus:

88 No Deposit Spins + 100% Up To £100

One of the most well-known online casinos in the UK, 888 Casino has been a household name since being founded in 1997. They now claim to have more than 17 million players worldwide and are regular winners at the annual EGR Awards. Best known for their innovation; they regularly offer their unique versions of traditional games that you won't find anywhere else. We're sure you've heard of them before, so why not dive the latest ongoings at 888 Casino?

|

Established |

1997 |

|

Total Games |

2,000+ |

|

Payout Speed |

24-72 Hours |

|

Withdrawal Limit |

x |

|

Devices |

iOS, MacOS, Windows, Android |

|

4.5 |

Excellent |

|

|

4.0 |

Good |

|

|

4.0 |

Good |

|

|

4.0 |

Good |

|

|

4.0 |

Good |

32 Exclusive Live Casino Games

88 Free Spins - No Deposit

Renowned & Trusted

No Instant Withdrawals

|

88 No Deposit Spins + 100% Up To £100 |

|

|

Min Deposit |

£20 |

|

Currencies |

CAD, USD, GBP, EUR |

|

Expiry |

14 Days |

|

Wagering Requirements |

30x |

|

Maximum Winnings |

£500 |

|

Playable on |

Selected Slot Games |

A unique welcome bonus is available for all new players at 888 Casino, with 88 no-deposit free spins & a 100% deposit bonus of up to £100 on offer. There are a handful of requirements, so it's important to take note of the following before claiming the 888 Casino welcome bonus.

To claim your deposit bonus, you must make your first deposit within 48 hours of creating your account.

Of course, the number of free spins is in keeping with the brand. These free spins are restricted to specific games and are clearly outlined in the account creation process.

For your 88 no-deposit free spins, 30x wagering requirements are attached, but these requirements will also vary by which game you choose to play. The cash bonus carries 35x wagering requirements. Additionally, any bonus wins are capped at £500, excluding jackpot wins.

As some games do not count 100% towards these wagering requirements, it is important to check this on your game before you start spinning. It is quite normal that slot games will count the highest, while other classic casino games like blackjack or roulette will likely be much lower.

Our Thoughts on This Bonus

Breaking down this bonus, there's plenty to like. 88 free spins as a no deposit bonus is generous, and a great way to view the 888 Casino game offereing. Throwing a decent deposit match into the ring with slightly below average wagering requirements, and you've got a nice bonus. The only downside is the limited maximum win, which does slightly hamper this bonus. Nevertheless, there's plenty to like here.

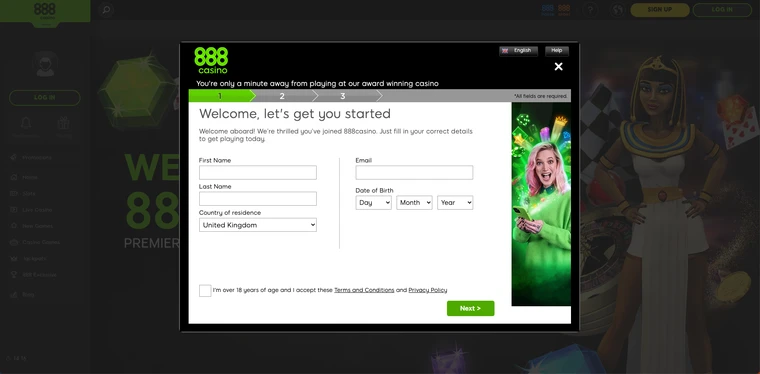

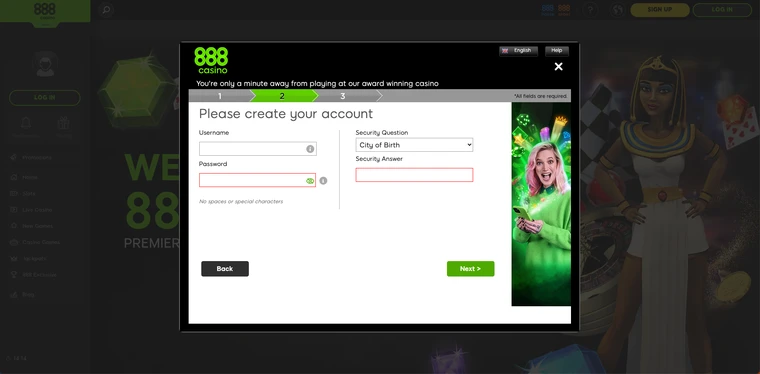

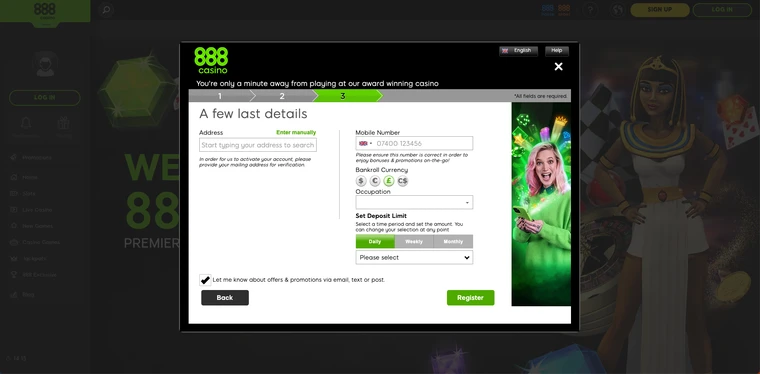

There’s an easy process for signing up at 888 Casino, and you’ll need a few pieces of information before playing any games. Name, date of birth and email address are all required fields, as well as a security question of your choosing.

Before any withdrawals, you’ll need to verify your age with a copy of your photographic ID. This can be a copy of a passport, driver's licence or national ID card.

888 Casino adds an additional step not seen at many online casinos, a security question. It's great to see an online casino pay such close attention to security and safety, and on the whole, the registration process was very smooth and fast.

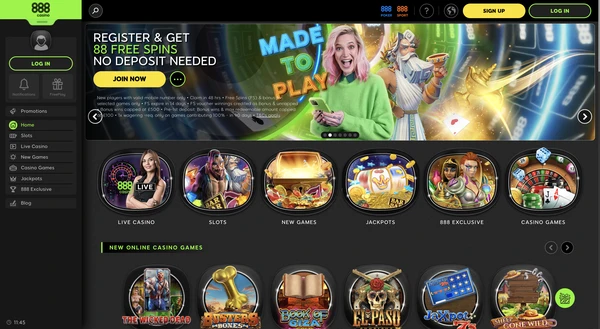

Upon launching 888 Casino, you’ll be greeted with an exciting homepage, packed with top picks and the latest online casino games.

Atop the page, you’ll notice eight tabs that will automatically scroll through, notifying you of the latest promotions as well as the daily lucky wheel and safer gambling notices.

Accessing your wallet could not be easier, and you’ll be able to see your balance at all times in the top right corner of the screen.

As you scroll further down the homepage, you’ll see the top 10 games in your country, which are frequently updated to reflect the most popular selections at the casino.

There are 15 sections overall on the homepage, including personalised top picks, slot games, live casino offerings and plenty more. This gives you quick access to the complete library of online casino games, as soon as you launch the website.

One of this casino’s most significant selling points is the fact it offers more than 2,000 titles on its casino. While most of these are slot games, there are also plenty of fantastic blackjack, roulette and baccarat options for those who prefer to play the more controllable casino games.

When it comes to online slots, they have all bases covered, with all the latest releases complemented by old favourites such as Safari Riches, 88 Fortunes and Starburst.

In addition, 888 Casino is proud to produce a variety of exclusive slot games, which can’t be played anywhere else.

There are roughly 1,500 different slot titles, which means you will have to look pretty hard to find an online slot they don’t have!

Pragmatic Play | RTP: 96.71%

Novomatic | RTP: 96.06%

Microgaming | RTP: 96.4%

Snowborn Games | RTP: 94%

Our Thoughts on 888 Casino's Slots

Exclusive slots, jackpot slots, Megaways slots - 888 Casino really has the lot. They always have all the latest slot releases, as well as offering a growing collection of games you can't play anywhere else. They may not be able to compete simply on numbers with 3,000+ slot casinos, but they should have everything a slots player could want. A classic online slot casino!

The live casino options at 888 Casino are some of the best in online casinos and it is perhaps the standout feature here, with 420+ games available.

Regular favourites roulette and blackjack are available, with more than 80 live roulette tables with different variations of the classic game.

For live blackjack players, there are a remarkable 170+ tables to choose from, all with differing staking requirements and maximum payouts. They even host a large number of VIP tables, for those players looking to play at higher stakes.

There are more than 25 live game show games, with titles such as Adventures Beyond Wonderland and Monopoly Big Baller. These are exciting games to play, with the potential to receive huge payouts whilst having a more fun online casino experience.

Alternatively, there are also a decent number of baccarat and video poker options available, leaving you spoilt for choice with live card games

|

Live Games |

Total |

|---|---|

|

Live Roulette |

88 |

|

Live Blackjack |

176 |

|

Live Baccarat |

83 |

|

Live Poker |

16 |

|

Live Game Shows |

25 |

|

Exclusive |

32 |

|

Total |

420 |

Our Thoughts on 888 Casino's Live Casino

There's a number of things we look for in a good live casino - and 888 Casino really do have the lot. A huge collection of tables, exclusive games and a varied range of game show games. With so many different tables available, you should never struggle to find a seat here - which can often be a gripe of ours with other online casinos.

888 Casino tends to work with only the biggest and most well-known list of games providers. Those developers are among the most active, meaning new releases are added consistently to the overall games schedule. They also have a live casino packed full of the best releases from industry heavyweights, Playtech and Evolution Gaming.

888 Casino complies with all guidelines published by eCOGRA, which ensure that all approved online casino offerings are properly and transparently monitored to provide player protection.

888 online casino is regulated by the UK Gambling Commission, and it confirms its UKGC licence at the bottom of the homepage. Details of licensing are also provided for Malta and Gibraltar.

All UK casinos need to be honest about their licensing, and customers can easily check these details as they are very open and transparent about their legitimacy.

|

License

|

Name

|

Registration Number

|

Country

|

|---|---|---|---|

|

|

GRA

|

112 & 113

|

Gibraltar

|

|

|

MGA

|

CRP/543/2018

|

Malta

|

|

|

UKGC

|

39028

|

United Kingdom

|

Given their size and popularity, it comes as little surprise that 888 Casino provides a wealth of payment options for their players.

All deposits should be instant, while withdrawals will take 48 to 72 hours, depending on the method used. The fastest withdrawal method is PayPal, with a total withdrawal time of 24-48 hours. There are no withdrawal fees attached, regardless of the method used.

|

Payment Method

|

Name

|

Deposit Amount

|

Withdrawal Amount

|

Withdrawal Time

|

|---|---|---|---|---|

|

|

£20 Min

|

-

|

7-10 Days

|

|

|

|

£20 Min

|

£30,000 Max

|

2-3 Days

|

|

|

|

£20 Min

|

£30,000 Max

|

2-3 Days

|

|

|

|

£10 Min

|

£30,000 Max

|

2-3 Days

|

|

|

|

£20 Min

|

£30,000 Max

|

6 Days

|

|

|

|

£10 Min

|

£30,000 Max

|

10 Days

|

|

|

|

£20 Min

|

£30,000 Max

|

1-8 Days

|

|

|

|

£10 Min

|

£10 Min

|

1-6 Days

|

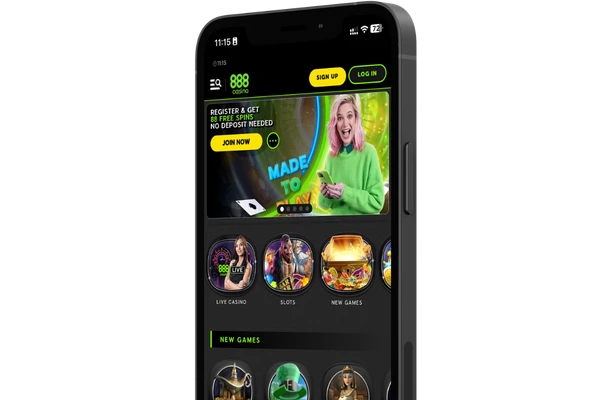

For mobile players, 888 Casino is accessible through both your mobile browser and a dedicated mobile app. None of the fantastic features of the desktop site are lost when playing on mobile, and you’re able to get the same fantastic online casino experience at your fingertips.

We’d recommend downloading the mobile app, which is available on both iOS and Android devices. A simple installation process is needed, and the app reflects the main site with fantastic quality, allowing HD graphics and fantastic live dealer games.

The app has a 4.5 rating from over 29,000 players on the App Store and requires a minimal 30.1MB of storage. Similarly, 23,000 Android users have delivered a 4.4 rating on the Play Store - so the popularity of this online casino app should not be in question!

Of course, should you not wish to download the app, you can also play from your mobile browser. It will come equipped with HTML 5 technology, so as long as you hold a strong internet connection, you’ll be able to play easily from your mobile.

|

|

support@888casino.com |

|

Phone |

02038768708 |

|

Live Chat |

Yes |

|

Availability |

24/7 |

|

Language |

Danish, English, German, Italian, Russian, Spanish, Swedish |

They have all bases covered when it comes to Customer Support:

Classic email and telephone support services are also available, as well as a comprehensive FAQ section.

Despite having a wide social media presence, 888 Casino’s social channels do not focus on customer support.

Given the stature of 888 Casino, it’s not surprising that they have an easy-to-understand loyalty program. Known simply as ‘Comp Points’, their tagline regarding this loyalty program is, ‘You Play, We Pay’.

Every £10 wagered will earn you 1.5 comp points, and in turn, these points can be converted into cash. The beauty of this loyalty program is that there are no wagering requirements attached to any bonus funds earned through comp points, and you are free to play as you please.

The conversion rate for these points differs for each currency, with 150 points equal to £1 in cash. For Euros, you’ll earn 1 Euro for every 135 points earned. You’ll be able to keep track of any comp points earned by heading to ‘My Account’ and selecting ‘My Points’.

Comp Points are converted in multiples of 100, and any remaining points can be rolled over to be redeemed at a later date. For example, if you had managed to earn 460 Comp Points, you would convert 400 points into £3, and the remaining 10 points would be carried forward.

The maximum comp points accumulated within a month are limited to 5,000,000, so we imagine you won’t have to worry about losing out on any bonuses.

Please note that if you do not log in to your account in 90 days, any comp points in the account will be forfeited, and you’ll lose any bonuses.

Whilst not being the most profitable of loyalty programs, Comp Points is certainly an easy way to earn cash and is one of the most efficient loyalty programs of any online casino.

888 Casino is a fantastic all-around online casino - and it is certainly one of our favourites at CasinoRange. A slot library of more than 1,500 titles will have all the bases covered, with all the latest online slot releases complemented by a growing number of exclusive games. In addition, they have a strong live casino offering supported by the biggest names in the casino industry.

Meanwhile, when it comes to the bonus on offer, new customers are created with an incredible 88 no-deposit free spins, as well as 100% up to £100 in bonus cash. Additionally, both the cash and free spins come with fair wagering requirements and a max win of £500.

In terms of website infrastructure, they should have everything covered too, with them offering a generous welcome bonus, a wide selection of payment methods, decent withdrawal times and strong customer support, which is available 24/7. This is before you even mention the 888 Casino app, which as their online scores will demonstrate, is loved by their players.

If you’re looking for an online casino that has all bases covered, 888 Casino is not a bad place to start…

Currently, they do have a live chat feature, which is available 24/7. Do bear in mind though, you may have to answer a few questions regarding your problem before you encounter a real person, but you will be able to get through once your issue has been narrowed down.

888 Casino is a completely legitimate and licensed online casino, regulated by the UK Gambling Commission. In addition, they gain fairness approval from independent auditors, eCogra, so you can be certain your money is safe and secure.

Available on iOS and Android, 888 Casino has a mobile app on which you can play all your favourite casino games. The app is free to download from both the App Store and Play Store and has received some fantastic reviews and ratings from players.

The minimum withdrawal amount at 888 Casino, with any payment method, is £10.

To claim the 888 Casino welcome bonus, open an account and get your 88 no-deposit free spins. However, when you deposit a minimum of £20, within 48 hours of opening your account, the casino will match your deposit. Any winnings from these bonus funds are capped at £500, excluding jackpot wins.

PayPal is an accepted deposit and withdrawal method at 888 Casino, with withdrawal times of up to 48 hours.

Author

Content Writer

100% Up To £50 + 20 Free Spins

Up To £200 & Up To 100 Free Spins

100% up to £200

100 Free Spins

Up To £100 & 200 Extra Spins

Stake £10, Get 100 Free Spins - No Wagering

150% Up To £50 + 50 Free Spins

121% Up To £100

100% Up To £80

Deposit £20 & Get 520 Bonus Spins

Up To £100 & 200 Extra Spins

Deposit £10, Get 132 Free Spins

100% Up To £25 & 25 Free Spins